Oxide Semiconductor Thin-Film Transistors Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Advances, and Global Opportunities

- Executive Summary & Market Overview

- Key Technology Trends in Oxide Semiconductor Thin-Film Transistors

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

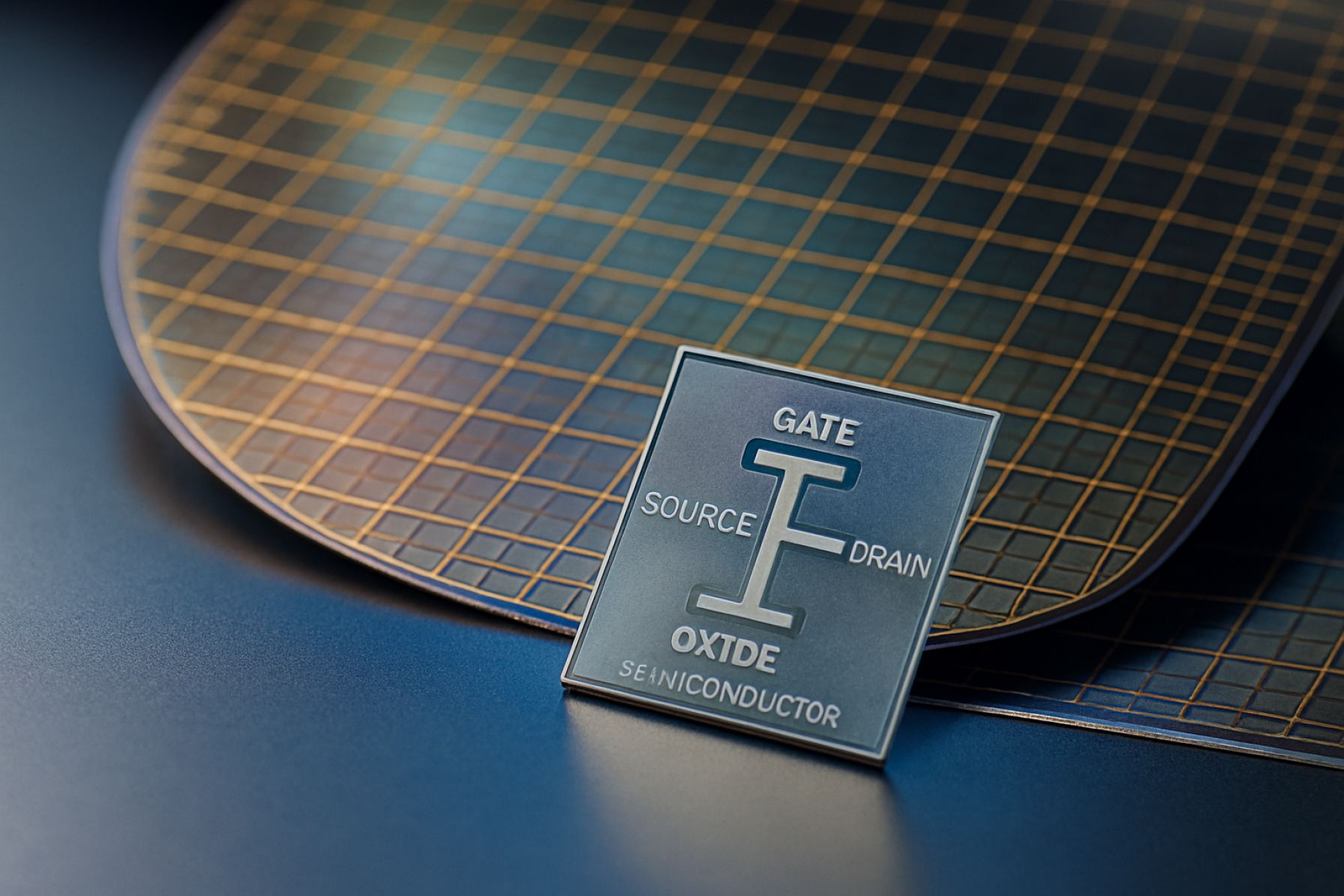

Oxide semiconductor thin-film transistors (TFTs) represent a pivotal advancement in the field of display and electronics technology. These transistors utilize oxide materials—most notably indium gallium zinc oxide (IGZO)—as the active semiconductor layer, offering significant improvements over traditional amorphous silicon (a-Si) TFTs in terms of electron mobility, transparency, and stability. As of 2025, the global market for oxide semiconductor TFTs is experiencing robust growth, driven by escalating demand for high-performance displays in consumer electronics, automotive, and industrial applications.

The proliferation of high-resolution, energy-efficient displays in smartphones, tablets, laptops, and televisions is a primary growth driver. Oxide TFTs enable higher pixel densities and faster refresh rates, which are essential for next-generation OLED and LCD panels. According to International Data Corporation (IDC), the global shipment of advanced display panels is projected to increase steadily through 2025, with oxide TFTs capturing a growing share due to their superior characteristics.

In addition to consumer electronics, the automotive sector is emerging as a significant adopter of oxide TFT technology. The integration of advanced infotainment systems, digital dashboards, and head-up displays in vehicles is fueling demand for robust, high-brightness, and reliable display solutions. MarketsandMarkets estimates that the automotive display market will reach $10.5 billion by 2025, with oxide TFTs playing a crucial role in this expansion.

Geographically, Asia-Pacific remains the dominant region, led by major display manufacturers in South Korea, Japan, and China. Companies such as LG Display, Samsung Display, and Sharp Corporation are at the forefront of oxide TFT development and commercialization. These firms are investing heavily in research and production capacity to meet the surging global demand.

Despite the positive outlook, the market faces challenges such as high material costs and complex manufacturing processes. However, ongoing innovations and economies of scale are expected to mitigate these issues over time. Overall, the oxide semiconductor TFT market in 2025 is characterized by rapid technological progress, expanding application scope, and intensifying competition among leading industry players.

Key Technology Trends in Oxide Semiconductor Thin-Film Transistors

Oxide semiconductor thin-film transistors (TFTs) are at the forefront of next-generation display and electronics technologies, driven by their superior electrical properties, transparency, and compatibility with flexible substrates. In 2025, several key technology trends are shaping the evolution and adoption of oxide semiconductor TFTs, particularly in the context of advanced display panels, sensors, and emerging flexible electronics.

- High-Mobility Materials: The industry is witnessing a shift towards high-mobility oxide semiconductors such as indium gallium zinc oxide (IGZO) and zinc tin oxide (ZTO). These materials offer electron mobilities significantly higher than traditional amorphous silicon, enabling faster switching speeds and higher resolution displays. Sharp Corporation and LG Display are leading adopters of IGZO TFTs in commercial products, particularly for 4K and 8K panels.

- Flexible and Foldable Electronics: The compatibility of oxide TFTs with low-temperature processing is accelerating their use in flexible and foldable displays. This trend is supported by ongoing research into solution-processable oxide semiconductors, which can be deposited on plastic substrates, paving the way for rollable and wearable devices. Samsung Electronics and BOE Technology Group are investing heavily in this area.

- Improved Stability and Reliability: Addressing the instability issues of oxide TFTs, such as threshold voltage shifts under bias stress, remains a key focus. Innovations in passivation layers, channel engineering, and device architecture are enhancing operational stability, making oxide TFTs more viable for demanding applications like automotive and industrial displays. Texas Instruments and Toshiba Corporation are notable contributors to reliability research.

- Integration with Advanced Display Technologies: Oxide TFTs are increasingly being integrated with OLED and microLED backplanes, thanks to their high current-driving capability and transparency. This integration supports ultra-thin, high-brightness, and energy-efficient displays, a trend highlighted in recent product launches by Sony Group Corporation and Apple Inc.

- Scalability and Cost Reduction: Efforts to scale up oxide TFT manufacturing and reduce costs are ongoing, with advancements in large-area deposition techniques and solution-based processes. Market analysts from IDC and DisplaySearch project that these innovations will drive broader adoption across consumer electronics and IoT devices in 2025.

Competitive Landscape and Leading Players

The competitive landscape for oxide semiconductor thin-film transistors (TFTs) in 2025 is characterized by a mix of established electronics giants, specialized material suppliers, and innovative startups, all vying for leadership in a market driven by demand for high-performance displays and next-generation electronics. The sector is particularly influenced by the rapid adoption of oxide TFTs in advanced display technologies such as OLED, QLED, and micro-LED panels, where their superior mobility and stability over traditional amorphous silicon TFTs are critical advantages.

Key players dominating the oxide semiconductor TFT market include Samsung Electronics, LG Display, and Sharp Corporation. These companies leverage their vertically integrated manufacturing capabilities and extensive R&D investments to maintain technological leadership, particularly in the mass production of large-area and high-resolution displays. Samsung Electronics and LG Display have both commercialized displays using indium gallium zinc oxide (IGZO) TFTs, which offer higher electron mobility and lower power consumption compared to conventional materials.

Material suppliers such as Ushio Inc. and DuPont play a crucial role by providing high-purity oxide materials and deposition technologies essential for the fabrication of high-performance TFTs. These suppliers are increasingly collaborating with display manufacturers to develop customized solutions that address specific performance and scalability requirements.

In addition to established players, the market is witnessing the emergence of innovative startups and research-driven companies, such as Cambrios and Helio Display Materials, which are focusing on novel oxide compositions and process optimizations. These entrants are often at the forefront of developing flexible and transparent electronics, expanding the application scope of oxide TFTs beyond traditional displays to include wearable devices and smart surfaces.

Strategic partnerships, licensing agreements, and joint ventures are common as companies seek to accelerate commercialization and secure intellectual property. The competitive intensity is further heightened by ongoing investments in R&D, with a focus on improving device reliability, reducing manufacturing costs, and enabling new form factors. As a result, the oxide semiconductor TFT market in 2025 is marked by dynamic competition, rapid innovation cycles, and a clear trend toward integration with emerging display and electronic technologies.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The oxide semiconductor thin-film transistor (TFT) market is poised for robust growth between 2025 and 2030, driven by escalating demand for high-performance display technologies and the proliferation of advanced consumer electronics. According to projections from MarketsandMarkets, the global oxide semiconductor TFT market is expected to register a compound annual growth rate (CAGR) of approximately 10–12% during this period. This growth trajectory is underpinned by the increasing adoption of oxide TFTs in next-generation displays, such as OLED and high-resolution LCD panels, as well as their expanding use in flexible and transparent electronics.

Revenue forecasts indicate that the market, valued at around USD 2.5 billion in 2025, could surpass USD 4.5 billion by 2030, reflecting both volume expansion and value-added innovation. The Asia-Pacific region, led by countries such as South Korea, Japan, and China, is anticipated to maintain its dominance, accounting for over 60% of global revenue share due to the concentration of major display panel manufacturers and ongoing investments in R&D and production capacity (International Data Corporation (IDC)).

Volume analysis reveals a parallel surge, with unit shipments of oxide semiconductor TFTs projected to grow from approximately 1.2 billion units in 2025 to over 2.1 billion units by 2030. This increase is attributed to the rapid integration of oxide TFTs in large-area displays for televisions, monitors, and tablets, as well as their emerging role in automotive displays and wearable devices (DisplaySearch).

- CAGR (2025–2030): 10–12%

- Revenue (2025): USD 2.5 billion

- Revenue (2030): USD 4.5+ billion

- Volume (2025): 1.2 billion units

- Volume (2030): 2.1+ billion units

Key growth drivers include the superior electron mobility and stability of oxide semiconductors compared to traditional amorphous silicon, enabling higher resolution and energy-efficient displays. The market outlook remains positive, with ongoing technological advancements and expanding application areas expected to sustain double-digit growth through 2030 (OMICS International).

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global oxide semiconductor thin-film transistor (TFT) market is witnessing dynamic regional trends, with North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each contributing distinctively to market growth in 2025.

North America remains a significant player, driven by robust R&D investments and the presence of leading display and semiconductor companies. The region benefits from strong demand for advanced display technologies in consumer electronics, automotive, and healthcare sectors. The U.S. in particular is home to major research institutions and technology firms, fostering innovation in oxide TFTs for applications such as high-resolution OLED and flexible displays. According to International Data Corporation (IDC), North America’s adoption of next-generation display panels is expected to sustain steady market growth through 2025.

Europe is characterized by a focus on sustainable electronics and stringent environmental regulations, which are accelerating the adoption of oxide semiconductor TFTs due to their lower power consumption and eco-friendly manufacturing processes. The region’s automotive and industrial sectors are increasingly integrating advanced display solutions, further propelling demand. Germany, France, and the UK are leading the charge, supported by collaborative initiatives between academia and industry. Statista reports that Europe’s share in the global advanced display market is set to grow, with oxide TFTs playing a pivotal role in this expansion.

Asia-Pacific dominates the oxide semiconductor TFT market, accounting for the largest revenue share in 2025. This leadership is underpinned by the presence of major display panel manufacturers in countries such as South Korea, China, Japan, and Taiwan. Companies like Samsung Electronics, LG Display, and Sharp Corporation are at the forefront of mass-producing oxide TFT-based panels for smartphones, TVs, and emerging applications like foldable and transparent displays. The region’s rapid urbanization, expanding middle class, and government support for electronics manufacturing further fuel market growth. According to Display Daily, Asia-Pacific’s oxide TFT production capacity is expected to outpace other regions through 2025.

Rest of the World (RoW) is experiencing gradual adoption, primarily in Latin America and the Middle East. Growth is driven by increasing investments in consumer electronics manufacturing and the gradual shift toward advanced display technologies. While the market share remains smaller compared to other regions, rising demand for smart devices and digital signage is expected to create new opportunities for oxide semiconductor TFTs in these emerging markets, as noted by MarketsandMarkets.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for oxide semiconductor thin-film transistors (TFTs) in 2025 is marked by a surge in emerging applications and concentrated investment in key technological hotspots. As the limitations of traditional amorphous silicon (a-Si) and low-temperature polysilicon (LTPS) TFTs become more apparent, oxide semiconductors—particularly indium gallium zinc oxide (IGZO)—are gaining traction for their superior electron mobility, transparency, and stability. This positions oxide TFTs as a critical enabler for next-generation display technologies and beyond.

One of the most prominent emerging applications is in advanced display panels, including high-resolution OLED and micro-LED displays for smartphones, tablets, and large-format TVs. The demand for ultra-high-definition, energy-efficient, and flexible displays is driving panel manufacturers to adopt oxide TFTs, which offer better performance and lower power consumption compared to legacy technologies. According to Display Daily, leading display makers in South Korea, Japan, and China are ramping up investments in oxide TFT production lines to meet the anticipated surge in demand for premium displays in 2025.

Beyond displays, oxide TFTs are finding new roles in sensor arrays, such as X-ray detectors for medical imaging and industrial inspection. Their high sensitivity and low leakage current make them ideal for large-area, high-resolution sensor backplanes. IDTechEx projects that the medical imaging sector will become a significant growth driver for oxide TFTs, with investments targeting the development of robust, low-cost sensor solutions.

Another emerging application is in transparent and flexible electronics, including wearable devices and smart windows. The inherent transparency and flexibility of oxide semiconductors enable innovative form factors and integration into non-traditional substrates. MarketsandMarkets highlights that venture capital and corporate R&D funding are increasingly flowing into startups and research groups focused on flexible oxide TFTs, particularly in North America and East Asia.

- East Asia (South Korea, China, Japan): Major investments in oxide TFT manufacturing for advanced displays and sensor applications.

- North America: Focus on R&D for flexible and transparent electronics, with growing interest from the wearable tech sector.

- Europe: Niche investments in medical imaging and industrial sensor applications.

In summary, 2025 is set to be a pivotal year for oxide semiconductor TFTs, with emerging applications in displays, sensors, and flexible electronics driving both technological innovation and targeted investment across global hotspots.

Challenges, Risks, and Strategic Opportunities

Oxide semiconductor thin-film transistors (TFTs) are gaining traction in advanced display technologies and flexible electronics, but the sector faces a complex landscape of challenges, risks, and strategic opportunities as it moves into 2025. One of the primary technical challenges is the stability and uniformity of oxide semiconductor materials, such as indium gallium zinc oxide (IGZO). These materials are sensitive to environmental factors like moisture and oxygen, which can degrade device performance and reliability over time. Manufacturers are investing in advanced encapsulation and passivation techniques to mitigate these risks, but the added process steps can increase production costs and complexity (LG Display).

Another significant risk is the supply chain volatility for critical raw materials, particularly indium and gallium. These elements are not only expensive but also subject to geopolitical and market fluctuations, which can impact pricing and availability. Companies are exploring alternative oxide compositions and recycling strategies to reduce dependency on these scarce resources (IDTechEx).

From a market perspective, oxide TFTs face stiff competition from established amorphous silicon (a-Si) and low-temperature polysilicon (LTPS) technologies, which have mature manufacturing ecosystems and cost advantages. The transition to oxide TFTs requires significant capital investment in new equipment and process development, posing a barrier for smaller players. However, the superior electron mobility and transparency of oxide semiconductors open strategic opportunities in high-resolution, energy-efficient displays for smartphones, tablets, and next-generation OLED and microLED panels (Display Daily).

- Strategic partnerships between material suppliers, equipment manufacturers, and display panel makers are emerging as a key trend to accelerate innovation and share risk.

- There is growing interest in leveraging oxide TFTs for flexible and wearable electronics, where their mechanical properties and low-temperature processing offer unique advantages.

- Regulatory and sustainability pressures are prompting R&D into less toxic and more abundant oxide materials, which could reshape the competitive landscape by 2025.

In summary, while oxide semiconductor TFTs face material, supply chain, and competitive risks, the sector’s strategic opportunities in advanced displays and flexible electronics are driving continued investment and innovation.

Sources & References

- International Data Corporation (IDC)

- MarketsandMarkets

- LG Display

- Samsung Display

- BOE Technology Group

- Texas Instruments

- Toshiba Corporation

- Apple Inc.

- DuPont

- Statista

- Display Daily

- IDTechEx