Orbital Debris Remediation Technologies in 2025: Unleashing Innovation to Secure Space for the Next Decade. Explore How Cutting-Edge Solutions Are Transforming the Market and Safeguarding Our Orbits.

- Executive Summary: The Urgency and Opportunity in Orbital Debris Remediation

- Market Overview 2025: Size, Segmentation, and Key Drivers

- Growth Forecast 2025–2030: CAGR, Revenue Projections, and Investment Trends (Estimated CAGR: 18–22%)

- Technology Landscape: Current Solutions and Emerging Innovations

- Competitive Analysis: Leading Players, Startups, and Strategic Alliances

- Regulatory Environment and International Collaboration

- Challenges and Barriers: Technical, Financial, and Policy Hurdles

- Case Studies: Successful Missions and Pilot Projects

- Future Outlook: Next-Gen Technologies and Market Evolution to 2030

- Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: The Urgency and Opportunity in Orbital Debris Remediation

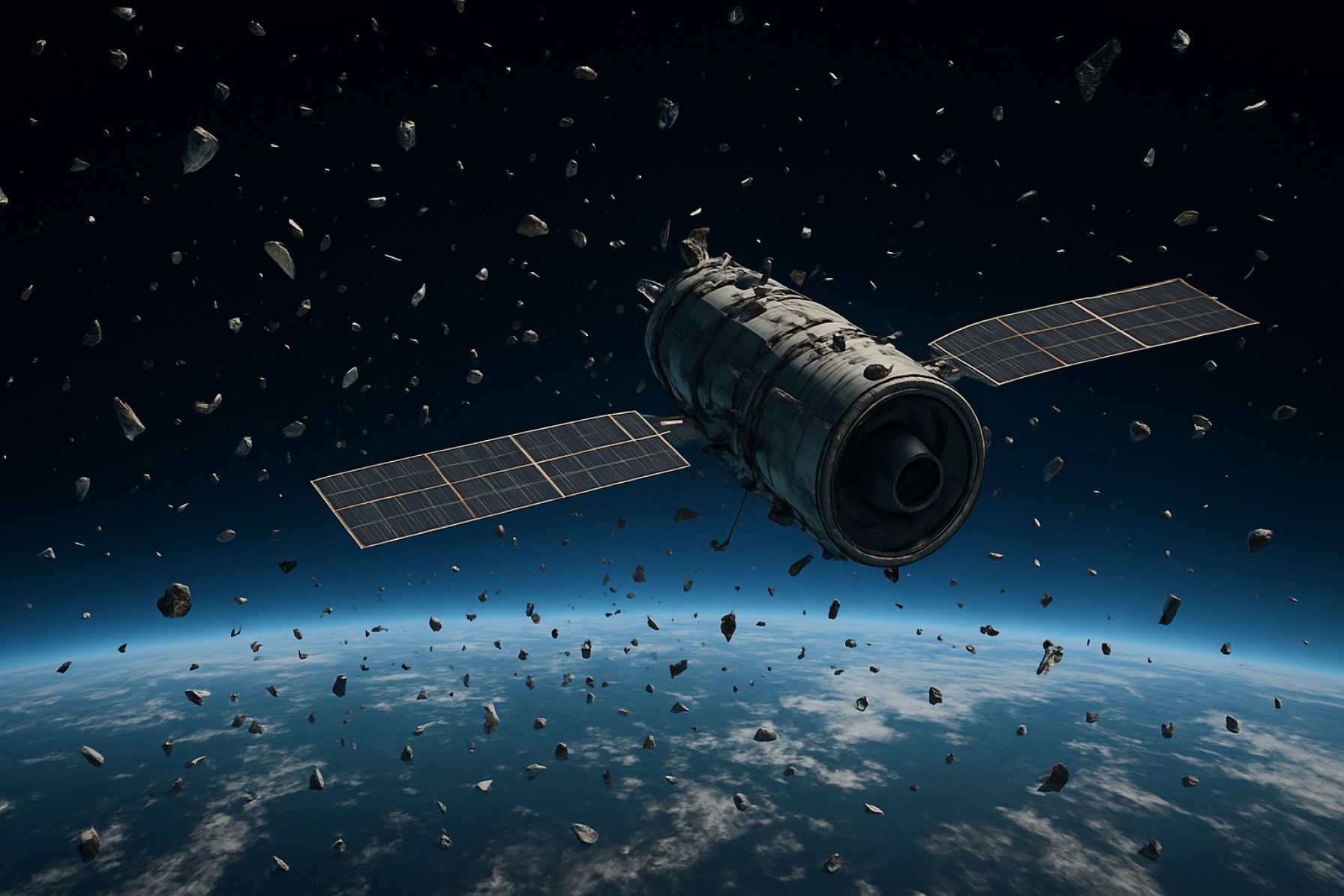

The proliferation of orbital debris—defunct satellites, spent rocket stages, and fragments from collisions—poses a mounting threat to the sustainability of space activities. As of 2025, the urgency to address this issue has reached a critical juncture. The exponential increase in satellite launches, particularly from commercial constellations, has intensified congestion in low Earth orbit (LEO), raising the risk of cascading collisions known as the Kessler Syndrome. This scenario could jeopardize not only current space operations but also future scientific, commercial, and defense missions.

Recognizing the gravity of the situation, international organizations and national space agencies have prioritized the development and deployment of orbital debris remediation technologies. These solutions range from active debris removal (ADR) systems—such as robotic arms, nets, and harpoons—to advanced tracking and collision avoidance platforms. The European Space Agency and NASA have spearheaded research and demonstration missions, while private sector innovators are rapidly advancing commercial capabilities for debris capture and deorbiting.

The opportunity in this sector is significant. As regulatory frameworks evolve, satellite operators face increasing pressure to comply with debris mitigation guidelines and end-of-life disposal requirements. This regulatory momentum, combined with the growing economic value of space-based infrastructure, is driving investment in remediation technologies. Companies such as Astroscale Holdings Inc. and ClearSpace SA are pioneering commercial debris removal missions, signaling a shift toward a sustainable space economy.

In summary, 2025 marks a pivotal year for orbital debris remediation. The convergence of technological innovation, regulatory action, and market demand is accelerating the deployment of solutions to safeguard the orbital environment. Stakeholders across the public and private sectors must collaborate to ensure that space remains accessible and secure for generations to come.

Market Overview 2025: Size, Segmentation, and Key Drivers

The market for orbital debris remediation technologies is poised for significant growth in 2025, driven by escalating concerns over space sustainability and the increasing density of debris in low Earth orbit (LEO). As of early 2025, industry estimates suggest that over 34,000 pieces of debris larger than 10 cm and millions of smaller fragments are tracked in orbit, posing substantial risks to operational satellites and crewed missions. This has catalyzed demand for innovative remediation solutions, including active debris removal (ADR), in-orbit servicing, and advanced tracking systems.

Market segmentation in 2025 reflects a diverse landscape. By technology, the sector is divided into mechanical capture (e.g., robotic arms, nets), contactless methods (e.g., lasers, ion beams), and hybrid approaches. Mechanical systems, such as those developed by European Space Agency and Japan Aerospace Exploration Agency (JAXA), are leading in demonstration missions, while laser-based solutions are gaining traction for their potential in deorbiting small debris. By end-user, the market is segmented into government space agencies, commercial satellite operators, and defense organizations, with government-led initiatives currently dominating due to regulatory and funding support.

Key drivers shaping the market in 2025 include the proliferation of mega-constellations, stricter international guidelines, and heightened liability concerns. The surge in satellite launches by companies like SpaceX and OneWeb has intensified the urgency for debris mitigation, as collision risks threaten both commercial and scientific missions. Regulatory frameworks, such as those advocated by the United Nations Office for Outer Space Affairs (UNOOSA), are pushing for compliance with debris mitigation standards, further stimulating market activity.

In summary, the orbital debris remediation technologies market in 2025 is characterized by robust growth prospects, diverse technological approaches, and a strong regulatory impetus. As stakeholders across the public and private sectors recognize the critical importance of space environment sustainability, investment and innovation in this sector are expected to accelerate, shaping the future of safe and sustainable space operations.

Growth Forecast 2025–2030: CAGR, Revenue Projections, and Investment Trends (Estimated CAGR: 18–22%)

The orbital debris remediation technologies sector is poised for robust expansion between 2025 and 2030, with industry analysts projecting a compound annual growth rate (CAGR) in the range of 18–22%. This surge is driven by escalating concerns over space sustainability, the proliferation of satellite constellations, and mounting regulatory pressure to mitigate the risks posed by space debris. Revenue projections for the sector suggest that the global market could surpass several billion USD by 2030, as both governmental and commercial stakeholders intensify investments in active debris removal (ADR), in-orbit servicing, and end-of-life management solutions.

Key investment trends indicate a shift from early-stage research and demonstration missions to the deployment of operational systems. Notable funding rounds and public-private partnerships have been announced by leading space agencies such as the European Space Agency and NASA, as well as commercial entities like Astroscale Holdings Inc. and ClearSpace SA. These organizations are advancing technologies including robotic arms, nets, harpoons, and propulsion-based deorbiting modules, with several demonstration missions scheduled for launch within the forecast period.

The anticipated growth is further supported by evolving regulatory frameworks, such as the Federal Communications Commission’s updated orbital debris mitigation rules and the United Nations Office for Outer Space Affairs’s guidelines on the long-term sustainability of outer space activities. These policies are expected to drive compliance-related investments, particularly among satellite operators and launch service providers.

Venture capital and strategic corporate investments are increasingly targeting scalable, cost-effective remediation solutions, with a focus on technologies that can address both large, defunct satellites and smaller debris fragments. The emergence of insurance incentives and liability frameworks is also catalyzing market growth, as stakeholders seek to minimize operational risks and potential financial losses from debris collisions.

Overall, the 2025–2030 period is set to witness accelerated commercialization and technological maturation in orbital debris remediation, underpinned by strong revenue growth, regulatory momentum, and a dynamic investment landscape.

Technology Landscape: Current Solutions and Emerging Innovations

The technology landscape for orbital debris remediation is rapidly evolving, driven by the increasing density of space debris in low Earth orbit (LEO) and the growing recognition of its threat to both operational satellites and future space missions. Current solutions primarily focus on tracking, collision avoidance, and active debris removal (ADR). Leading space agencies such as NASA and European Space Agency (ESA) have developed sophisticated ground- and space-based tracking systems to monitor debris, enabling satellite operators to perform collision avoidance maneuvers. However, these measures are largely preventive and do not address the root problem of existing debris.

Active debris removal technologies are at the forefront of remediation efforts. Notable approaches include robotic arms, nets, harpoons, and drag augmentation devices. For example, ESA’s ClearSpace-1 mission, scheduled for launch in the coming years, aims to demonstrate the viability of using a robotic spacecraft to capture and deorbit a defunct satellite. Similarly, Japan Aerospace Exploration Agency (JAXA) has tested electrodynamic tethers designed to slow down debris, causing it to re-enter the atmosphere and burn up. These missions represent significant milestones in demonstrating the technical feasibility of ADR.

Emerging innovations are expanding the toolkit for debris remediation. Companies such as Astroscale Holdings Inc. are developing commercial services for end-of-life satellite removal and in-orbit servicing, including magnetic docking and controlled deorbiting. Laser-based solutions, such as ground-based lasers to nudge small debris into lower orbits, are also under investigation by organizations like JAXA and Commonwealth Scientific and Industrial Research Organisation (CSIRO). Additionally, the concept of “just-in-time collision avoidance” using small, targeted interventions to alter debris trajectories is gaining traction.

Despite these advances, significant challenges remain, including the high cost of ADR missions, legal and regulatory uncertainties, and the technical complexity of capturing fast-moving, uncooperative objects. Nevertheless, the convergence of public and private sector initiatives, coupled with international collaboration, is accelerating the development and deployment of orbital debris remediation technologies, setting the stage for more sustainable space operations in 2025 and beyond.

Competitive Analysis: Leading Players, Startups, and Strategic Alliances

The competitive landscape of orbital debris remediation technologies in 2025 is characterized by a dynamic mix of established aerospace companies, innovative startups, and strategic alliances that aim to address the growing threat of space debris. Leading players such as Northrop Grumman Corporation and Airbus Defence and Space have leveraged their extensive experience in satellite and space systems to develop active debris removal (ADR) solutions, including robotic arms and capture mechanisms. These companies often collaborate with governmental agencies like NASA and the European Space Agency (ESA) to test and deploy new technologies in orbit.

Startups have injected agility and novel approaches into the sector. Astroscale Holdings Inc. has emerged as a frontrunner, with its ELSA-d mission demonstrating magnetic capture and deorbiting of defunct satellites. Similarly, ClearSpace SA is advancing its ClearSpace-1 mission, which is scheduled to perform the world’s first removal of a large debris object in collaboration with ESA. These startups often benefit from public-private partnerships and funding from space agencies, which accelerates technology maturation and deployment.

Strategic alliances are pivotal in this sector, as the complexity and cost of debris remediation require shared expertise and resources. For instance, Japan Aerospace Exploration Agency (JAXA) has partnered with Astroscale Holdings Inc. for joint technology demonstrations, while ESA collaborates with ClearSpace SA and other European industrial partners to develop scalable ADR missions. Additionally, industry consortia such as the Space Data Association facilitate data sharing and coordination among satellite operators to prevent collisions and inform remediation strategies.

The competitive environment is further shaped by regulatory developments and international guidelines, which incentivize compliance and innovation. As the market matures, the interplay between established aerospace giants, nimble startups, and cross-sector alliances is expected to drive technological breakthroughs and commercial viability in orbital debris remediation.

Regulatory Environment and International Collaboration

The regulatory environment for orbital debris remediation technologies is rapidly evolving as the proliferation of space debris poses increasing risks to both operational satellites and future space missions. National and international regulatory frameworks are being updated to address the challenges of debris mitigation, active removal, and long-term sustainability of outer space activities. Key regulatory bodies such as the United Nations Office for Outer Space Affairs (UNOOSA) and the International Telecommunication Union (ITU) provide guidelines and recommendations for debris mitigation, but binding international laws remain limited.

In 2025, the focus has shifted toward fostering international collaboration to develop and implement effective debris remediation technologies. The European Space Agency (ESA) and NASA have both launched initiatives to support active debris removal missions and promote best practices for satellite end-of-life disposal. For example, ESA’s Clean Space initiative and NASA’s Orbital Debris Program Office are working on guidelines for the design and operation of spacecraft to minimize debris generation and encourage the adoption of remediation technologies.

Bilateral and multilateral agreements are increasingly common, with agencies such as Japan Aerospace Exploration Agency (JAXA) and China National Space Administration (CNSA) participating in joint research and demonstration missions. These collaborations aim to standardize technical requirements and share data on debris tracking and removal, which is essential for the safe and coordinated use of remediation technologies in shared orbital environments.

National regulatory authorities, such as the Federal Communications Commission (FCC) in the United States, are also updating licensing requirements to mandate debris mitigation plans for commercial satellite operators. These regulations increasingly require operators to demonstrate compliance with international guidelines and to consider active debris removal as part of their mission planning.

Despite progress, significant challenges remain in harmonizing regulations across jurisdictions and ensuring compliance, particularly as private sector involvement in space increases. Continued international dialogue and the development of binding agreements will be critical to the successful deployment and scaling of orbital debris remediation technologies in the coming years.

Challenges and Barriers: Technical, Financial, and Policy Hurdles

The development and deployment of orbital debris remediation technologies face a complex array of challenges spanning technical, financial, and policy domains. Technically, the diversity and velocity of debris in low Earth orbit (LEO) present significant obstacles. Debris objects vary widely in size, shape, and material composition, complicating detection, tracking, and capture. Technologies such as robotic arms, nets, harpoons, and laser systems must operate with extreme precision to avoid creating additional fragments or inadvertently damaging active satellites. Moreover, the harsh space environment—characterized by radiation, temperature extremes, and microgravity—demands robust and reliable engineering solutions, which are still under active development and testing by organizations like the European Space Agency and NASA.

Financial barriers are equally daunting. The high cost of research, development, launch, and operation of debris removal missions often outweighs the immediate economic benefits, especially since the “polluter pays” principle is not yet universally enforced in space law. Private sector investment remains limited due to uncertain returns and the lack of a clear business model for debris removal. While some companies, such as Astroscale Holdings Inc., are pioneering commercial debris removal services, widespread adoption is hampered by the absence of consistent funding mechanisms and incentives for satellite operators to participate in remediation efforts.

Policy and regulatory hurdles further complicate progress. The current international legal framework, including the Outer Space Treaty and Liability Convention, does not clearly assign responsibility for debris remediation or establish enforceable standards for debris mitigation and removal. Jurisdictional ambiguities arise when debris crosses national boundaries or involves defunct satellites owned by multiple entities. Efforts by the United Nations Office for Outer Space Affairs and national agencies to develop guidelines and best practices are ongoing, but binding agreements remain elusive. Additionally, concerns about the dual-use nature of debris removal technologies—potentially applicable to anti-satellite operations—raise security and trust issues among spacefaring nations.

Addressing these challenges will require coordinated international action, sustained investment, and continued technological innovation. Without overcoming these barriers, the risk of cascading collisions and the long-term sustainability of space activities remain pressing concerns for the global community.

Case Studies: Successful Missions and Pilot Projects

Recent years have seen a surge in pilot projects and missions aimed at demonstrating the feasibility of orbital debris remediation technologies. These case studies highlight the progress and challenges in actively reducing space debris, a growing concern for the sustainability of space operations.

One of the most prominent missions is the ELSA-d (End-of-Life Services by Astroscale-demonstration) by Astroscale Holdings Inc.. Launched in 2021, ELSA-d was the world’s first commercial mission to demonstrate technologies for capturing and removing defunct satellites. The mission successfully tested rendezvous, capture, and safe deorbiting maneuvers using a magnetic docking mechanism, setting a precedent for future commercial debris removal services.

Another significant initiative is the ClearSpace-1 mission, led by ClearSpace SA in partnership with the European Space Agency (ESA). Scheduled for launch in 2026, ClearSpace-1 aims to capture and deorbit a large, non-functional upper stage from low Earth orbit using a robotic arm system. This mission is notable for its focus on removing a real, existing piece of debris, and for being the first debris removal contract awarded by a major space agency.

Japan’s CRYDRAGON project, under the Japan Aerospace Exploration Agency (JAXA), is another example. JAXA has been testing electrodynamic tether technology, which uses long, conductive tethers to generate drag and accelerate the deorbiting of debris. Early tests have demonstrated the potential for this passive, fuel-free approach to be scaled for larger debris objects.

These missions underscore the technical and regulatory complexities of debris remediation. They also highlight the importance of international collaboration and public-private partnerships in developing scalable solutions. As these pilot projects transition to operational services, they pave the way for a more sustainable and secure orbital environment.

Future Outlook: Next-Gen Technologies and Market Evolution to 2030

The future of orbital debris remediation technologies is poised for significant transformation as the space industry accelerates toward 2030. With the proliferation of satellites and mega-constellations, the urgency to address space debris has never been greater. Next-generation solutions are moving beyond conceptual stages, with several promising technologies entering demonstration and early operational phases.

Active debris removal (ADR) is at the forefront of these advancements. Technologies such as robotic arms, nets, harpoons, and ion-beam shepherds are being refined for greater reliability and cost-effectiveness. For instance, European Space Agency (ESA) is collaborating with commercial partners to develop missions like ClearSpace-1, which aims to capture and deorbit defunct satellites using a robotic arm. Similarly, Japan Aerospace Exploration Agency (JAXA) is testing electrodynamic tether systems to accelerate the orbital decay of debris.

Laser-based debris nudging, which uses ground- or space-based lasers to alter the trajectory of small debris, is also gaining traction. This non-contact approach is being explored by organizations such as NASA and German Aerospace Center (DLR), with the potential to mitigate collision risks without creating additional fragments.

Looking ahead, the integration of artificial intelligence (AI) and autonomous systems is expected to revolutionize debris tracking, identification, and removal. AI-driven algorithms will enable real-time decision-making for collision avoidance and optimal debris capture, while autonomous servicing vehicles could perform complex remediation tasks with minimal human intervention.

Market evolution is also anticipated, with the emergence of dedicated debris removal service providers and new business models. Regulatory frameworks are being updated to incentivize responsible end-of-life satellite disposal and to support commercial ADR missions. Initiatives by Federal Communications Commission (FCC) and international bodies are shaping a more robust legal and insurance environment for debris remediation.

By 2030, the convergence of advanced robotics, AI, and international policy is expected to make orbital debris remediation a routine aspect of space operations. The sector’s growth will be driven by both government and private investment, ensuring safer and more sustainable access to Earth’s orbits for future generations.

Strategic Recommendations for Stakeholders

As the proliferation of orbital debris poses escalating risks to both current and future space operations, stakeholders—including government agencies, commercial satellite operators, and international organizations—must adopt a coordinated and proactive approach to remediation technologies. The following strategic recommendations are designed to guide stakeholders in advancing effective orbital debris mitigation and removal efforts in 2025 and beyond.

- Prioritize Active Debris Removal (ADR) Demonstrations: Stakeholders should support and invest in ADR missions that demonstrate scalable, cost-effective technologies. Initiatives such as the European Space Agency‘s ClearSpace-1 and Japan Aerospace Exploration Agency‘s CRD2 projects exemplify the importance of real-world testing to validate capture, deorbit, and disposal techniques.

- Standardize Debris Mitigation Guidelines: Harmonizing technical standards and best practices across the industry is essential. Collaboration with organizations like the Inter-Agency Space Debris Coordination Committee can help ensure that new satellites are designed for end-of-life disposal and that post-mission passivation is universally adopted.

- Incentivize Compliance and Innovation: Regulatory bodies should consider implementing incentives—such as reduced licensing fees or priority launch slots—for operators who comply with debris mitigation protocols or deploy novel remediation technologies. Partnerships with agencies like the Federal Communications Commission and NASA can facilitate these frameworks.

- Foster International Collaboration: Given the transboundary nature of orbital debris, multilateral agreements and joint missions are critical. Stakeholders should engage with the United Nations Office for Outer Space Affairs to develop binding international norms and share technical expertise.

- Support Research and Dual-Use Technologies: Investment in research on debris tracking, AI-driven collision avoidance, and dual-use technologies (e.g., servicing and refueling satellites) can yield both commercial and remediation benefits. Collaboration with industry leaders such as Northrop Grumman and Astroscale Holdings Inc. can accelerate technology maturation.

By implementing these recommendations, stakeholders can collectively reduce the long-term risks posed by orbital debris, safeguard valuable space assets, and ensure the sustainable use of Earth’s orbital environment.

Sources & References

- European Space Agency

- NASA

- United Nations Office for Outer Space Affairs (UNOOSA)

- Japan Aerospace Exploration Agency (JAXA)

- Commonwealth Scientific and Industrial Research Organisation (CSIRO)

- Northrop Grumman Corporation

- Airbus Defence and Space

- Space Data Association

- International Telecommunication Union (ITU)

- China National Space Administration (CNSA)

- German Aerospace Center (DLR)